Wondering how to lower your property taxes? The property tax appeal process is easier than you may think!

I’ve appealed my property taxes twice in the past and have gotten them lowered both times. The whole process took only a few minutes each time. I want to share my experience with you to show you how simple it can be.

A Look at How to Lower Your Property Taxes

While the rules for appealing your property tax assessment vary by jurisdiction, there are many commonalities no matter where you live.

In most cases, the appeal process begins with you filling out paperwork at the tax assessor’s office. But many municipalities are now encouraging people to start the appeals process via email.

There are a few basic grounds for appeal in most places:

- Value (You believe the assessor is assigning your home a value that's too high.)

- Uniformity (You feel your home and a similar home are being taxed at two very different rates.)

- Taxability (This usually applies to corporate entities.)

- Exemption denial (Homestead exemption may or may not be a thing where you live.)

We've gotten a lot of questions to our Consumer Action Center asking whether it's necessary to hire a lawyer to lower your property taxes. The answer to that question is no. In most cases, you can do it yourself, and we're going to show you how in this article.

Table of Contents:

- Look at Your Annual Notice of Assessment

- Find the Most Recent Comps

- File Your Property Tax Appeal

- Get Ready to Wait

1. Look at Your Annual Notice of Assessment

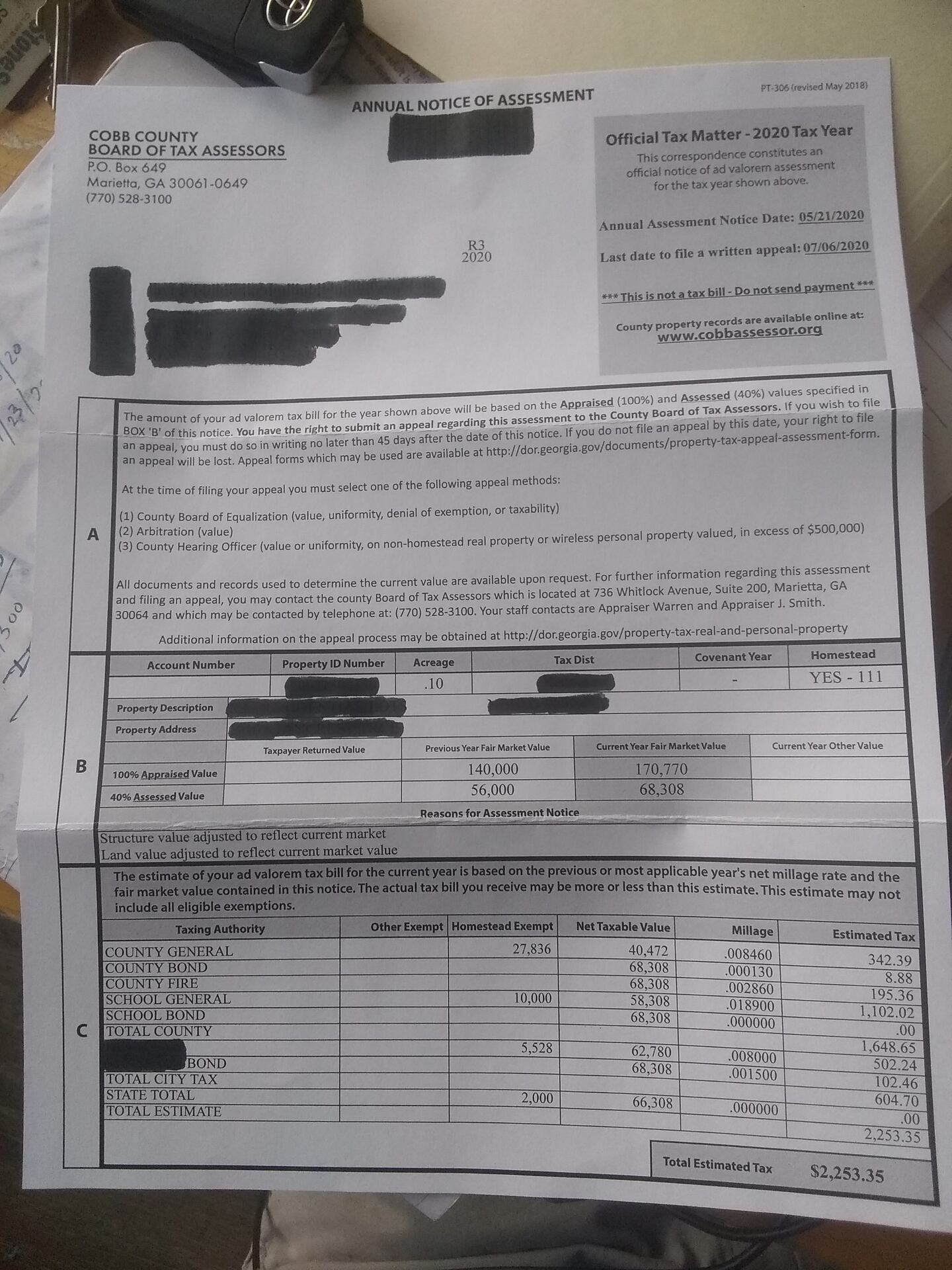

When people get their annual notice of assessment in the mail, that’s when they typically get fired up about lowering their property taxes.

The key piece of information you’ll want to note on yours is the year-to-year change in your property’s appraised value.

In my case, the appraised value jumped from $140,000 to $170,770 in just one year.

That’s an increase of $30,770 — a nearly 22% rise in a very short period of time!

When I first got this assessment in the mail, I thought that was crazy. However, as I went through the property tax appeal process, I came to find out that it wasn’t as far-fetched as I’d believed.

You can see this year’s value of a sample property in the shaded area below. Right next to it, you’ll see last year’s value.

2. Find the Most Recent Comps

In real estate lingo, "comps" are what you call the sale prices of homes that are similar to yours nearby. Some people like to look at comps on the web. Sites like Zillow and Trulia are good for that. However, I prefer to go in person to my Board of Tax Assessors to see the recent comps they've got on file.

Of course, with the pandemic there are limited office hours this year. But I went a different route: I still had the business card of the property appraiser who pulled my comps the last time I filed to lower my property taxes.

So I dropped him an email, explained my situation, gave him my property ID number from my annual notice of assessment, and he pulled updated comps for me. This approach to getting recent comps may or may not work for you, but that was my experience.

Here are the comps that the tax assessor pulled for me that reflect the most recent sales in my neighborhood.

I’ve highlighted in yellow the two most important pieces of information you’re looking for: the square footage and the sale price.

I live in an HOA covenant community where all of the attached townhomes look essentially the same on the outside. That’s why square footage is particularly important to me. I want to know the most recent sale price of homes that have the same square footage (1,386 sq. ft.) that I do.

If I can demonstrate a trend of homes that are 1,386 sq. ft. in my neighborhood selling for less than my current year fair market value ($170,770), then I feel I have sufficient grounds to go through the property tax appeal process based on value.

In my case, I couldn’t. The numbers just didn’t support it, so I’ll pay my tax as assessed — but you get the idea!

You’ll want to make sure the comps you’re looking at offer as much of an apples-to-apples comparison as possible. So in addition to square footage, that means finding properties with a similar bedroom/bathroom count and similar property acreage.

3. File Your Property Tax Appeal

If you decide that you do want to go through with an appeal, there will typically be a form you can fill out either online or at the office of your Board of Tax Assessors.

This year, most counties are only accepting requests to lower your property taxes via email because of the pandemic.

Either way, it’s simple to fill out the form or drop an email. I’ve done a property tax appeal twice since buying my home. Each time, I’ve only spent a few minutes sizing up market conditions and values based on comps. Then I filled out the paperwork to explain why I believed my appeal was warranted. Both times the county agreed with me.

A simple form email can suffice. Last time I filed an appeal, I wrote something like this:

"The 20XX comp report indicates XX properties in my community being sold for $XXX,XXX or less. These XX properties are the same square footage as mine. I have made no material upgrades to warrant a higher valuation."

Just remember to include these basics in your email:

- State your reason for appeal. Typically, this will be value, uniformity, taxability or exemption denial.

- Remember to include your property ID number, full street address, name, contact information, etc.

Finally, be sure to check with your municipality before emailing them to see if there’s any additional information you need to include.

4. Get Ready to Wait

Be prepared to wait after you file your appeal. You’ll typically get a letter in the mail acknowledging that your appeal has been received and letting you know when a decision will be made.

When you get the final decision, there are a few possible outcomes. The assessors could agree with you and revise your value downward. If that’s the case, all is good. You’ve accomplished your goal and you’re done.

If you get a letter of denial, you can either let your appeal die or you can opt to appear before a board of your fellow taxpayers to press your case.

That formal body is called the “Board of Equalization” where I live. The board is made up of three homeowners in my county. Each board member must go through a minimum of 40 hours of training to be able to understand home values and market conditions and to hear appeals.

There’s no fee to go before the board, by the way.

A couple of words of advice about going before a board of equalization…

- Never gripe about the government during your hearing. Just present the facts about recent sale prices of homes similar to yours.

- Dress nicely but not too well. Business casual should suffice. People will hopefully respond positively to your appearance on a subconscious level.

If you still don’t get the outcome you want after going through this process, you can consider going to court for a jury trial.

If you’ve reached this stage, you probably mean business and should prepare accordingly. This is when you would want to consider hiring an attorney who deals in property tax issues. As the appellant, you’ll be responsible for paying a nominal court filing fee in addition to paying your attorney.

Final Thought

There are a lot of reasons why you may want to appeal and lower your property taxes. For example, a sudden rise in valuation could bump your monthly mortgage payment up unexpectedly. This would likely happen if your mortgage holder keeps money aside each month in escrow to pay your property tax bill once a year.

Of course, the flip side of a rise in housing values can be great — especially if you’re looking to sell your home.

If you have additional questions about how to lower your property taxes, you can reach out to our Consumer Action Center for free advice.

More Related Stories on Clark.com:

- Is a Cash-Out Refinance Right for You?

- Best and Worst Home Insurance Companies

- How to Buy a House in 9 Steps

The post How to Lower Your Property Taxes in 4 Easy Steps appeared first on Clark Howard.